📱 Top Smartphone Brands India Q1 2025 – Official IDC Report

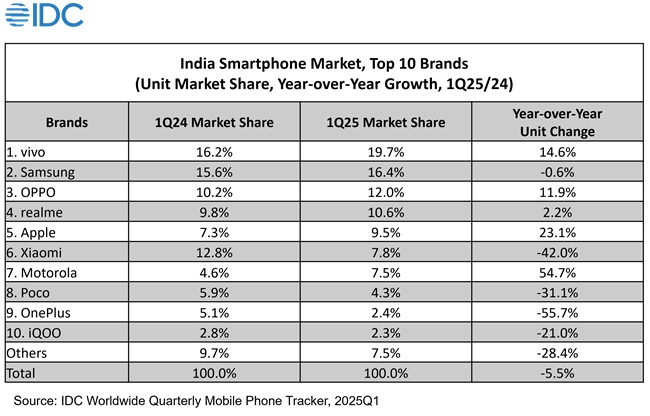

The Indian smartphone market continues to evolve, showing a dynamic shift in leadership and performance trends among major brands. According to the official IDC Worldwide Quarterly Mobile Phone Tracker, India’s smartphone shipments for Q1 2025 stood at 32 million units, marking a 5.5% year-on-year (YoY) decline. While the overall market dipped, several key brands posted strong growth, reshaping the top 10 rankings compared to Q1 2024.

Vivo led the market with a 19.7% share, marking a solid YoY growth. Apple and Motorola also posted impressive gains, while Xiaomi and OnePlus experienced sharp declines. Let’s dive into the brand-wise comparison.

📊 Q1 2025 vs Q1 2024 – Market Share Comparison

| Brand | Q1 2024 Share | Q1 2025 Share | YoY Change | Status |

|---|---|---|---|---|

| Vivo | 16.2% | 19.7% | +3.5% | Gaining |

| Samsung | 15.6% | 16.4% | +0.8% | Stable |

| OPPO | 10.2% | 12.0% | +1.8% | Gaining |

| realme | 9.8% | 10.6% | +0.8% | Stable |

| Apple | 7.3% | 9.5% | +2.2% | Highest Growth |

| Xiaomi | 12.8% | 7.8% | -5.0% | Declining |

| Motorola | 4.6% | 7.5% | +2.9% | Gaining |

| Poco | 5.9% | 4.3% | -1.6% | Declining |

| OnePlus | 5.1% | 2.4% | -2.7% | Declining |

| iQOO | 2.8% | 2.3% | -0.5% | Slight Decline |

Source: IDC Worldwide Quarterly Mobile Phone Tracker, Q1 2025

The data presented above is based on official IDC tracker results for the Indian smartphone market in Q1 2025. It highlights trends in consumer demand, mid-range growth, premium adoption, and overall brand performance. This information helps buyers, sellers, and tech enthusiasts understand how brands like Vivo, Apple, Xiaomi, Motorola, and Samsung performed during the first quarter of 2025. This IDC-based analysis provides not just market share data, but also strategic insights for brands, retailers, and buyers across India. These trends will shape the smartphone industry for the rest of 2025.

🔍 Brand-Wise Performance Breakdown

Vivo – Dominating Both Offline & Online

Vivo saw the highest shipment volume in Q1 2025, thanks to strong offline sales and well-timed launches in the ₹15K–₹25K range. Its growth of 14.6% YoY came from popular models like the Vivo V30, Y200e, and T2x 5G, helping it capture 19.7% of the market.

Apple – Highest YoY Growth (23.1%)

Apple recorded its best Q1 in India ever, growing 23% YoY. Driven by strong demand for iPhone 15 and 16 series, combined with retail expansion and aggressive financing offers, Apple now holds a 9.5% share—its highest in India to date.

Motorola – Strong Comeback

Motorola surprised the market with 54.7% YoY growth, fueled by well-priced G-series and Edge phones. The Moto G84, Edge 40 Neo, and G73 were key volume drivers, especially on Flipkart and other online channels.

Xiaomi – Major Decline

Xiaomi, once a market leader, saw its share fall from 12.8% to 7.8%. IDC attributes this drop to delayed launches, inventory mismanagement, and a lack of new competitive 5G devices in the ₹10K–₹20K segment.

OnePlus, Poco, iQOO – Losing Momentum

Each of these sub-brands experienced market share losses. OnePlus dropped by more than 2.5%, mainly due to an underwhelming Nord CE lineup. Poco saw a -1.6% drop, while iQOO slid slightly but remained active in the online mid-range segment.

📈 Segment Trends

The premium segment (₹30,000+) grew by 26% YoY, with Apple and Samsung holding 68% of that space. The mid-range segment remained highly contested, with realme, OPPO, and Vivo competing aggressively.

🌐 Useful Links

✅ Conclusion

The Indian smartphone landscape in Q1 2025 reflects changing consumer behavior and brand strategies. While brands like Vivo, Apple, and Motorola have adapted quickly to demand and price dynamics, Xiaomi, OnePlus, and Poco will need to recalibrate their approach to stay competitive in upcoming quarters.

Stay tuned with Mobi4Arena for in-depth smartphone insights, comparisons, and updates based on verified data!